- The Chase Savings℠ account interest rate is 0.01% APY (effective 9/14/2020; rates are variable and subject to change). Rates for the bank's premium relationship savings accounts are slightly.

- Our most popular savings account. Chase Savings(SM) account earns interest, FDIC insured, includes online and mobile banking with access to 16,000 branches & ATMs.

- The indicated rate displayed is 'Chase SavingsSM' product for the 10001 zip code or New York state. An opening deposit may be required. The rate of 0.01% is 0.63% lower than the average 0.64%. Also it is 2.14% lower than the highest rate 2.15 Updated Aug, 2020.

Earn more interest with a Chase Premier Savings(SM) account. FDIC insured, includes online and mobile banking with access to 16,000 branches & ATMs.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. UponArriving has partnered with CardRatings for our coverage of credit card products. UponArriving and CardRatings may receive a commission from card issuers.

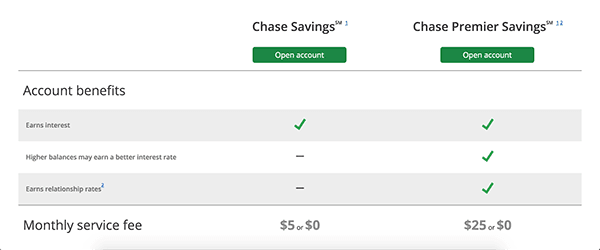

There are two main types of Chase savings account for the average consumer: Chase Savings and Chase Premier Savings. Below, I will go into detail about each of these accounts. I will show you all of the fees and how to avoid those fees and also give you some insight into the interest rates you can expect with a Chase savings account. And finally, I will also talk to you about the different types of bonuses you can get with these accounts and how valuable those can be.

Depending on the type of Chase account you open, you might have to pay $5 to $25 to keep your account open although there are several ways to get the fee waived.

Chase Savings fee & minimum daily balance

The monthly service fee for a Chase Savings account is five dollars but you can get this waived if:

- You have a balance at the beginning of each day of $300 or more in the account

- You have at least one repeating automatic transfer of $25 or more from your personal Chase checking account or Chase Liquid Card

- You are an account owner who is younger than 18

- You have a linked Chase personal checking account (excluding Chase High School Checking, Chase College Checking, Chase Secure Checking, Chase Total Checking, and Chase Checking)

Chase Premier Savings fee & minimum daily balance

The monthly service fee for a Chase Savings account is $25 but you can get this waived if:

- You have a balance at the beginning of each day of $15,000 or more in this account or you’re linked with Chase Premier Plus Checking or Chase Sapphire Checking.

Both accounts are subject to the $5 savings withdrawal limit fee. This applies to each withdrawal or transfer out of the account over six per monthly statement. However for the Chase Premier Savings this fee is waived if you have a balance of $15,000 or more in the account at the time of the transfer out.

Federal regulations (“Regulation D” to §204.2(d)(2)) restricts you to only six savings account withdrawals or transfers per monthly statement (this limit does not apply to withdrawals or transfers that are made in person at a branch office or at an ATM).

If you happen to exceed the federal limitations then Chase may convert your savings account into a checking account (a Chase Total Checking Account). They likely would only do this if it happen multiple times.

The big question a lot of people have with Chase savings accounts is what kind of interest rates you get. If you are hoping for industry leading yields for your savings accounts you will not find those with Chase.

Also, the interest rate that you get will depend on the type of account you open up and potentially how much money you keep in the account.

Below, I will show the interest rates as of April 2019 for my area of Texas but keep in mind that these can change in the future and based on your geographic location (although they often apply nationwide).

Chase Savings interest rates

The Chase Savings interest rate for all balances is .01%. This is not an impressive annual percentage yield and you can do much better than this with other savings accounts.

It is not that difficult to find savings accounts that offer 2% or more for the annual percentage yield. And some of those accounts don’t even require you to make any deposit or a large deposit. Therefore, if you are looking for one of the best APYs then this is not the account for you.

However, you also need to keep in mind the value that you can get from special bonuses offered when you open up an account and meet certain requirements. Keep reading below to see how lucrative these bonuses can be and what types of requirements that you need to meet.

Chase Premier Savings interest rates

The interest rates for the Chase Premier Savings accounts depend on the amount in your account. Here are the rates that I found:

$0-$9999

.04%

$10,000-$24,999

.04%

$25,000-$49,999

.04%

$50,000-$99,999

.07%

$100,000-$249,999

.07%

$250,000-$499,999

.09%

$500,000-$999,999

.09%

$1 million-$4,999,999

.09%

$5 million-$9,999,999

.09

$10,000,000+

.09%

Once again keep in mind that this was only a snapshot of the interest rates and that these could fluctuate depending on where you live and the time of checking.

If you open up a Chase savings account you also get the following benefits:

- Mobile check deposit

- Banker guidance

- Text banking

- Real-time fraud monitoring

- Paperless statements

If you are interested in a banking solution that has more substantive perks you might look into Chase Private Client or Sapphire banking.

If you would like you can open a Chase savings account online. To do so simply click here to get the process started.

It should not take very long for you to set up your account. If you are already a Chase customer you can sign in and the process will be faster since they already have some of your information.

You will need to provide some of your personal details such as your name and some of your identification information such as your citizenship, date of birth, social security number, and ID number (your drivers license works).

You will also need to provide your home address and your email address along with your phone number. If you are opening up a Chase joint savings account then be sure to have all of their information with you as well.

I highly recommend that you wait to sign up for a Chase Savings Account until you can jump on a special bonus and get a lot of free money. Click here for the latest bonus. If you sign-up right away the coupon code is automatically applied. Otherwise, you can have the coupon code emailed to you.

Note: if there is no branch in your state you may have issues proceeding with the enrollment online.

These special bonuses come in different forms but a lot of times they will look like the following.

Checking bonuses

There will often be a designated bonus for opening up a checking account. These bonuses can differ but it’s not uncommon to see a $200 to $300 bonus for opening up an account and doing some kind of action like setting up direct deposit.

Savings bonuses

For the Chase savings account bonuses you may be looking at something like a $200 bonus after opening up an account and performing certain actions. For example, you may have 20 days to deposit $15,000 in cash and then you will need to maintain that for 90 days in order to get the bonus.

Packaged bonuses

Then there are also bonuses that are a package deal. This allows you to capitalize on these earnings by opening up both a personal checking account and a personal savings account. When you meet the requirements above you might be given a sweet deal like a $600 bonus.

Once you have met the requirements you can expect to receive funds within 10 business days.

You can receive only one new checking and one new savings account opening related bonus every two years from the last enrollment date and only one bonus per account. There are usually deadlines for the special bonuses but they tend to be extended very often. So you don’t necessarily always have to be in a rush to open up these accounts.

The bonuses are considered interest so your earnings may be reported to the IRS. White rabbit slot free.

Best western casino royale reviews. These offers are typically not available to current customers. For example the terms and conditions usually state:

Checking offer is not available to existing Chase checking customers. Savings offer is not available to existing Chase savings customers.

Also if your accounts have been closed within 90 days or you have a negative balance you will not be eligible.

Am I automatically approved?

You will not be automatically approved for a Chase savings or checking account. It is not that difficult to get approved for one of these accounts but if you have very bad banking history with negative balances and a lot of closed accounts for example that could count against you.

Will there be a hard pull on my credit?

Chase Bank Savings Account Interest Rate

Whenever you open up a Chase savings account there will not to be a hard pull on your credit report. Therefore your credit score should not be impacted whatsoever by applying for an account.

How to close a Chase savings account

You cannot close your accounts online with an easy click. Instead, you can call the Chase customer service phone number 1(800) 935-9935 (representatives available 24 hours a day, 7 days a week).

You can also visit an in-branch office to close your savings account. Click here to search for Chase branches near you and be aware that many might not be open on Sunday. (You can use the filter feature to find banks open on Sunday.)

If you want to try to handle things online you can send a secured message and try that route though that’s not the quickest route to go.

Also, you can mail in your request with snail mail if you’d like as well. If you want to do that you’ll need to fill out this form and send it to the following address:

National Bank By Mail

P O Box 36520

Louisville, KY 40233-6520

Deliveries by Overnight or Certified Mail:

National Bank By Mail

Mail Code KY1-0900

416 West Jefferson, Floor L1

Louisville, KY, 40202-3202, United States

Is there a Chase savings account for college students?

I’m not aware of a Chase savings account for college students but they do have a Chase checking account for college students for college students 17 to 24 years old at account opening with proof of student status.

They also have checking accounts for high school students too (for students 13 to 17 years old at account opening with their parent/guardian as a co-owner and the account must be linked to the parent/guardian’s personal checking account). So if you’ve got kids 13 or older, you might look into this option for them.

Note: When the student turns 19, the Chase High School Checking account will become a Chase Total Checking account.

Is there a Chase health savings account?

Yes, the Chase Health Savings Account (HSA) is a special, tax-advantaged account you can use to pay for qualified medical expenses if you have a High Deductible Health Plan (HDHP) and meet all other eligibility requirements. You can find out more about it here.

Chase does not offer the best annual percentage yield for your savings account. In fact, it is very easy to find much more lucrative rates by shopping around with a quick search. The good news is that you can often jump on these bonus promotions where you can earn a lot of free money up front if you can meet certain requirements. In those situations, these savings accounts and checking accounts can actually be quite lucrative.

Betting app with free bet. UponArriving has partnered with CardRatings for our coverage of credit card products. UponArriving and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Daniel Gillaspia is the Founder of UponArriving.com and creator of the credit card app, WalletFlo. He is a former attorney turned full-time credit card rewards/travel expert and has earned and redeemed millions of miles to travel the globe. Since 2014, his content has been featured in major publications such as National Geographic, Smithsonian Magazine, Forbes, CNBC, US News, and Business Insider. Find his full bio here.

Related

Chase Bank, headquartered in Manhattan, New York, is the banking arm of JPMorgan Chase & Co., which has $2.6 trillion in assets and offers financial services worldwide. The bank says it serves half of the households in the United States, made possible because customers can easily access their services through more than 5,000 branch locations, 16,000 ATMs, an online platform, a mobile app and multiple points for support services, including social media channels like Twitter.

Customers looking for an institution with long-term stability may find it interesting that Chase links its history back to when Aaron Burr founded The Manhattan Company on September 1, 1799, at 40 Wall Street.

While Chase is a large bank, their interest rates across products are some of the lowest in the industry.

Chase Bank at a Glance

Pros

- 5,000+ branches and 16,000 ATMs

- Fees on basic checking can be avoided and there are several account options to choose from

- Personal banking benefits for qualifying military members

Cons

- Low interest rates on checking and savings accounts

- Heavy on fees

- $1,000 minimum balance on CDs

What’s interesting about Chase Bank

Chase has been around a long time. As one of the largest banks in the U.S., it is a recognized brand and a good choice for customers who want to bank with a large institution. The bank offers multiple options for checking and savings accounts. Chase Bank offers a wide range of products, including car loans, business loans, mortgages, home-equity lines of credit and investment advice. It’s easy to access Chase because they have thousands of branch locations and ATMs, a large online presence and 24/7 support.

Things to consider

While the bank offers several types of accounts, they usually come with fees that can be avoided but that require extra work for the customer. For the basic checking account, the bank charges a $2.50 fee for using non-Chase ATMs. Chase offers a lot of account perks, but with lower-than-average interest rates, customers won’t see their money grow as quickly as they might elsewhere.

Checking and Savings Accounts

Chase offers three types of checking accounts, all with monthly maintenance fees that can be avoided. These accounts are: Chase Total Checking, which does not earn interest and charges ATM fees; Chase Premier Plus Checking, which earns interest and has limited fees waived at non-Chase ATMs; and Chase Sapphire Checking, which earns interest, waives ATM fees worldwide and has a dedicated 24/7 service line for cardholders.

Chase offers two types of savings accounts: Chase Savings, which has a $5 monthly service fee that can be waived with a $300 daily balance, and Chase Premier Savings, which has a $25 monthly service fee that can be waived with a $15,000 balance.

Rates on checking and savings accounts are low compared to Chase’s competitors. However, the bank offers higher “relationship rates” to customers who link accounts, such as their checking account with their savings accounts, or a certificate of deposit (CD) with a checking account.

Money Market Accounts

Chase Bank does not offer a money market account. Some of the banks with the best money market accounts currently available include BBVA, with a $10,000 minimum deposit for a 1.50% APY interest rate — the highest out there. BMO Harris is another option, with a $5,000 minimum deposit for 2.05% APY, which is considered a high yield. Sallie Mae is also worth considering, as its money market account has a $0 minimum deposit and a competitive interest rate, which requires no minimum balance or fees.

CDs

CDs are available from Chase Bank in 1-month to 120-month term lengths and require a minimum of $1,000 investment. Customers can earn more money with long-term CDs and can get a higher interest rate with Chase’s “relationship rate boost” when they link their CD to their Chase personal checking account. CDs can be accessed at physical branch locations, as well as online and via smart devices. Customers opening a CD with a deposit of more than $100,000 must visit a branch location to complete the transaction.

Credit Cards

Current Chase Bank Savings Account Interest Rate

Chase has a full array of credit cards with offers that are considered among the best on the market. Chase usually makes sure a customer has a good or excellent credit rating before issuing a card. Several Chase cards are travel-related. Most feature cash back rewards, bonus offers and other perks. Chase cardholders get free credit scores, access to Chase’s Ultimate Rewards programs and 24/7 account access through the Chase Mobile app.

The most popular cards are the Chase Freedom Unlimited Card, which has no annual fee and unlimited 1.5% cash back on every purchase, and the Chase Freedom Card, which offers cash back on every purchase, plus the ability to earn 5% cash back up to $1,500 in bonus categories.

The Chase Slate card is also popular due to its 0% intro APR for 15 months from the account opening on balances and transfers, and the Chase Sapphire Preferred Card offers a $95 annual fee and 60,000 bonus points after spending $4,000 in the first 3 months, and the ability to earn 2x points on travel and restaurants.

There is also the Chase Sapphire Reserve, with a $450 annual fee, 50,000 bonus points after spending $4,000 in the first 3 months and 3x points on travel and dining.

Chase Bank credit card interest rates are comparable to those of other banks.

Personal Loans

Although Chase Bank is one of the most established and reputable banks in the nation, it does not offer personal loans to even those with amazing credit. If your credit is less than perfect but still fair, try securing a personal loan through Prosper. With interest rates as low as 6.95% (less than a credit card), it becomes easier to secure the funds you need for a wedding, debt consolidation, travel and more. Be aware that Prosper does charge origination fees depending on the amount you borrow, however, as it will be taken out of the loan amount.

Mortgage Loans

Fortunately, Chase Bank does offer mortgage loans to prospective homebuyers. The rates it offers are comparable, as well. With 15-year fixed mortgage rates as low as 2.875%, it can make homeownership a reality. However, like many banks, these rates are generally only accessible with excellent credit profiles. But if you already bank with Chase Bank, then securing a mortgage with it will be much more convenient.

Mortgage Refinance

This bank offers mortgage refinance products along with its standard mortgage products, but you’ll need an excellent credit score to qualify. If you do, you’ll get a really low refi rate and a ton of different term options to choose from. This bank’s mortgage refinance products are likely out of reach for people with good or fair credit, though.

Home Equity Loans and HELOCs

Chase Bank offers home equity loans and HELOCs, so you have the option to choose between a lump sum loan and a line of credit. As with Chase Bank’s other products, though, if you want to take advantage of their home equity products, you’ll need a strong credit profile to qualify. Chase’s home equity products currently have rates that range from 5.00% APY to nearly 8% depending on a number of factors, including the amount you’re borrowing or given access to on credit.

Car Loans

When it comes to Chase Bank car loans, the interest rate on your auto loan will depend on the make, model and year of the car you want to finance, as well as your credit rating and the amount you want to borrow. However, Chase Bank has created a new car-buying product called Chase Auto Preferred that connects car shoppers with a concierge at a dealership to better help customers with the car buying experience. This is only available in beta stages in Arizona, but is expected to expand into other states and dealerships. Chase Bank also provides a handy auto loan calculator on its website to help customers get a better picture of what their rates might be.

The Final Word

Chase Bank is one of the largest banks in the country, offering more services than many of its competitors. In addition to checking and savings accounts, CDs and credit cards, Chase Bank provides mortgages, auto loans and one of the broadest selections of credit cards in the industry. While savings interest rates tend to be low and some fees are high, Chase has a good basic checking account. Customers with less-than-stellar credit may not find Chase’s credit cards accessible. However, for customers with good credit who like the convenience of having all their accounts linked, and who feel more secure banking with a large institution, Chase’s offerings may be a good option.