When you have a lump sum amount in your pocket and you are confused where to invest the first thing which comes to your mind is investing the amount in fixed deposit. The fixed deposit is one of the most preferred way of investing money. In fixed deposit you block your money for a longer period such as for five years, 10 years or 20 years depending upon the tenure you have opted to invest your money. As this is a long term investment and some people hesitate to invest money for so much longer period.

There are people who want to have easy access to their money and they want to invest their money for a shorter duration due to other financial liabilities or other. For such investors the banks have come up with various options to invest their money for shorter duration the among these options flexi deposit is also very popular. Flexi deposit is one such investment instrument, which is equally popular among investors. It is very helpful in saving your money and achieving financial goals. But, some people got confused between these two investment tool. It is not very simple to make the decision as both have some advantages and disadvantages. So, it becomes more important to understand the differences of these two investment instruments and find out which one offers you more benefits.

Flexi Fixed Deposit Sbi Interest Rate

What is Flexi Fixed Deposit? Casino games with bonus rounds. A flexi fixed deposit is a combination of a fixed deposit and a savings account, ensuring customers to get the benefit of high interest rates offered by Fixed Deposits plus liquidity offered in saving accounts. How useful This Calculator? Steps to use this calculators - click here or scroll down.

If you make withdrawals frequently from your savings account which is linked with flexi and sweep in fixed deposit facilities, you will lose out on interest Sweep in and flexi- fixed deposits are. Flexi Fixed Deposit Access to your investment Minimum opening balance of N$ 100 and earn interest from N$ 1000 and above.

Let's find out some main differences between these two investment tools.

Different objective: Both the saving schemes have different objective. In fixed deposit you save money for longer duration for 3 years to 20 years and the term is pre-fixed. But in flexi deposit you choose a duration which is more convenient to you from one month to 15 months or more. In fixed deposit for longer tenure you deposit big amount, but in flexi deposit you deposit short amount on monthly basis, which converts into a big amount after maturity.

Short duration Vs. Long duration: The duration of the flexi fixed deposit and long term fixed deposit varies. The flexi fixed deposit you can avail from minimum 7 days to maximum 2 years. Besides, the long term fixed deposit is available for 5 years to 20 years. You can choose the tenure as per your ease. There is a huge difference in the duration of the flexi deposit and fixed deposit duration. Fixed deposit duration does not provide you flexibility where as flexi fixed deposit is popular becuase of its shorter and flexible duration.

Loan facility: There is no loan facility for flexi fixed deposit or short term fixed deposits. But, for fixed deposits of five years or more offers you facility to borrow the loan against the fixed deposit. You can borrow the loan of upto 90% of the amount of fixed deposit. This find of facility is not available for flexi deposits.

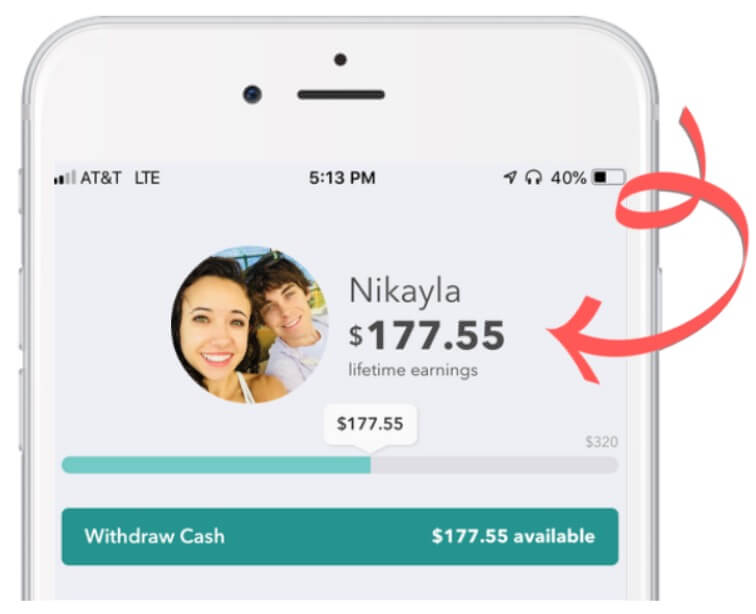

Apps That Pay You to Do Tasks & Mystery Shop Uber. Uber isn't exactly a quick way to make money, but if you love driving and you don't mind driving other people. Lyft, like Uber, is an excellent app if you're looking for a job that lets you set your own hours.

Apps That Pay You to Do Tasks & Mystery Shop Uber. Uber isn't exactly a quick way to make money, but if you love driving and you don't mind driving other people. Lyft, like Uber, is an excellent app if you're looking for a job that lets you set your own hours.

Tax benefits: Flexi fixed deposit does not offer you any kind of tax benefits, but long term fixed deposits such as five years fixed deposits or above five years offer you tax benefits under section 80C of income tax.

Difference in interest rates: The returns in longer duration fixed deposit is higher than the flexi fixed deposits. The interest you earn on your flexi fixed deposit is lower than longer duration fixed deposits.

Wynn Slots Wynn Slots brings you the highest quality Vegas casino slot machine games with numerous exciting slot games to play and an expanding library of high-quality slots games. Wynn Slots brings you the highest quality Vegas casino slot machine games. Starting with 8,000,000 free coins along with daily rewards and bonuses. Go head to head with. Wynn las vegas slot machines.

Withdrawal facility: You can withdraw your amount from flexi fixed deposit any time whenever you are in need. The money will be credited into your account within 24 working hours. Besides, in five years fixed deposit you can't withdraw the money before the tenure and in case you do so, you can't claim the tax benefits anymore on your fixed amount.

(Updated on:26th October,2016)

Flexi Fixed Deposit Fnb

| You are here : | Products International NRE Flexi Fixed Deposit |

NRE FLEXI FIXED DEPOSIT

This Deposit Scheme has integrated features of the Savings Deposit and Fixed Deposit. Through this scheme, you can enjoy the benefits like liquidity and ease of operation of savings account and higher returns on surplus funds like fixed deposits. The details of the scheme are as under: |

Eligibility | NRIs / PIOs/OCIs (other than person resident in Nepal and Bhutan) (Individuals from Pakistan require prior approval of RBI). |

Who can open this account? | Individuals |

Minimum balance in Savings Account | Rs. 50,000/- |

Sweep Out amount (From SB to Flexi Term Deposit account) | Rs. 10,000/- and in multiples of Rs. 10,000/- Upto Rs. 1 Crore per day |

Periodicity of Sweep out | Daily |

Sweep In amount ( From Flexi term Deposit to SB Account) | Rs. 5000/- and in multiples of Rs. 5000/- |

Period of Term deposit | 1 year |

Free benefits |

|

*Please note that the free benefit will be available only when the minimum balance is maintained at the time of event. | |

Rate of Interest

As applicable to Savings Bank Deposit and Fixed Deposit in force from time to time. Interest will be paid on a quarterly basis on the Fixed Deposit and credited into Savings Deposit Account.

Other Features:

- A passbook will be issued to the depositor with all the details of SB Flexi Account, the linked FD Flexi Account.

- No separate Deposit receipt shall be issued by the bank for the Union Flexi Deposit Scheme.

- Nomination facility Available

- No Loan/Overdraft/Lien will be permitted against the linked FD Flexi Account under this scheme